Lealman and Asian Neighborhood Family Center – serving as Past Treasurer, Past Vice Chair and current ChairĪn enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual and business tax returns, or through experience as a former IRS employee.Christ Evangelical Lutheran Church –Treasurer.Not-For-Profit Board Membership Affiliations:.National Society of Tax Professionals (NSTP).National Association of Tax Professionals (NATP).

#Annual taxes for small business llc professional#

Professional Affiliations (all memberships current) She maintains a high level of expertise participating in continuing professional education above and beyond what is required by the Internal Revenue Service and her professional affiliations. Lisa is active in her community sitting on the boards of not-for-profit organizations and is an active member in her church. In December 2016 she was awarded the prestigious title of Enrolled Agent. In 2016 she sat for and passed all three exams to become an enrolled agent.

She earned her Masters of Business Administration from the University of Phoenix, with a concentration in accounting. Her education continued at Florida Metropolitan University, a division of Tampa College, receiving her Bachelor of Science degree in Accounting, with a concentration in cost accounting. Lisa received her Associate of Arts degree from Saint Petersburg College, majoring in Accounting, with a minor in Sign Language Interpreting. along with the other divisions of Mangrove Financial Group LLC provide a multitude of client centric services. Mangrove Tax and Accounting Services Inc.

was re-branded to Mangrove Tax and Accounting Services Inc., to increase the number of client services available. In 2016 Visionary Financial Services Inc. Over the course of her career, she has helped countless individuals and small businesses with their unique situations and financial needs. Lisa possesses nearly three decades of experience in accounting, giving her the skills and savvy to open her own practice, Visionary Financial Services, in 2006.

#Annual taxes for small business llc code#

Code of EthicsĪs a member of the National Association of Tax Professionals. We take great pride in helping our clients achieve their financial goals. Lisa Ann Scopel, MBA – Accounting, EA, President " Publication 505 (2020), Tax Withholding and Estimated Tax." Accessed April 12, 2021.Our Business – Accounting and Tax Preparation

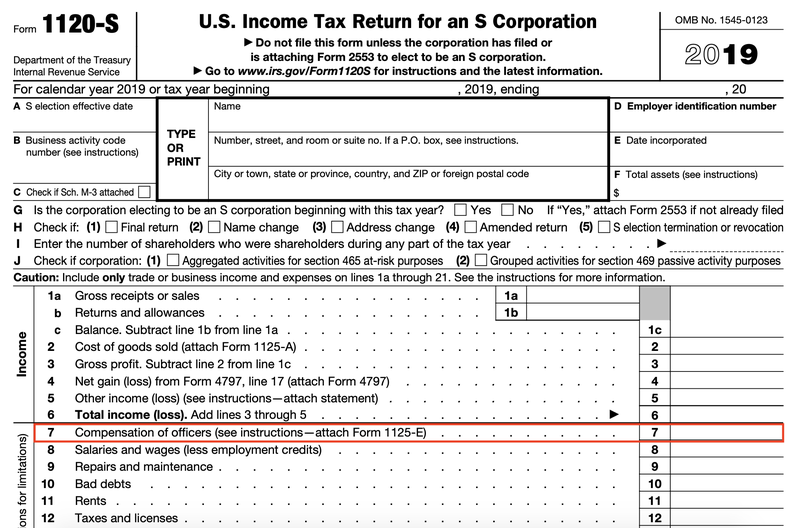

" Extension of Time To File Your Tax Return." Accessed April 12, 2021. " Shareholder's Instructions for Schedule K-1 (Form 1120-S) (2020)." Accessed April 12, 2021. " 2020 Instructions for Schedule C (2020)." Accessed April 12, 2021. " IRS Announces Tax Relief for Texas Severe Winter Storm Victims." Accessed April 12, 2021.

" Tax Day for Individuals Extended to May 17 Treasury, IRS Extend Filing and Payment Deadline." Accessed April 12, 2021. Sole proprietors file Schedule C with their personal tax returns to arrive at their net taxable business incomes. Its year-end is December 31, and the tax return due date is the same as the individual's-normally April 15, except it's May 17 in 2021.

0 kommentar(er)

0 kommentar(er)